How to e-file Form 8868 with ExpressExtension?

ExpressExtension supports Form 8868 to extend the filing deadline for tax-exempt organization returns. Upon filing Form 8868, organizations can receive a 6-month automatic extension of time to file their original tax-exempt returns. But this extension ONLY extends the time to file the original return, not the deadline to pay any taxes owed. The following tax-exempt organizations can file Form 8868:

-

Nonprofit organizations

-

Private foundations

-

Tax-exempt organizations with unrelated business income

-

Nonprofits with excise taxes

Follow the minimal steps to complete and file your Form 8868 extension with ExpressExtension:

Step 1: Sign in to your ExpressExtension account.

Step 2: Click the 'Start New Exempt Tax Extension 8868' button to file an extension for your tax-exempt return.

Step 3: Select your preferred method to complete the details for filing an extension. You have the following two options to import your information:

-

Manual Entry - By selecting this option, you need to manually enter all the required information in the respective fields.

-

Bulk Import - This is recommended when filing a high volume of extension forms. We offer a wide range of bulk import options to easily file the extension forms correctly and accurately, ensuring that risk of errors and mistakes. To see how to file multiple 8868 forms using the bulk upload option, click here.

Here, we select the 'Manual Entry.'

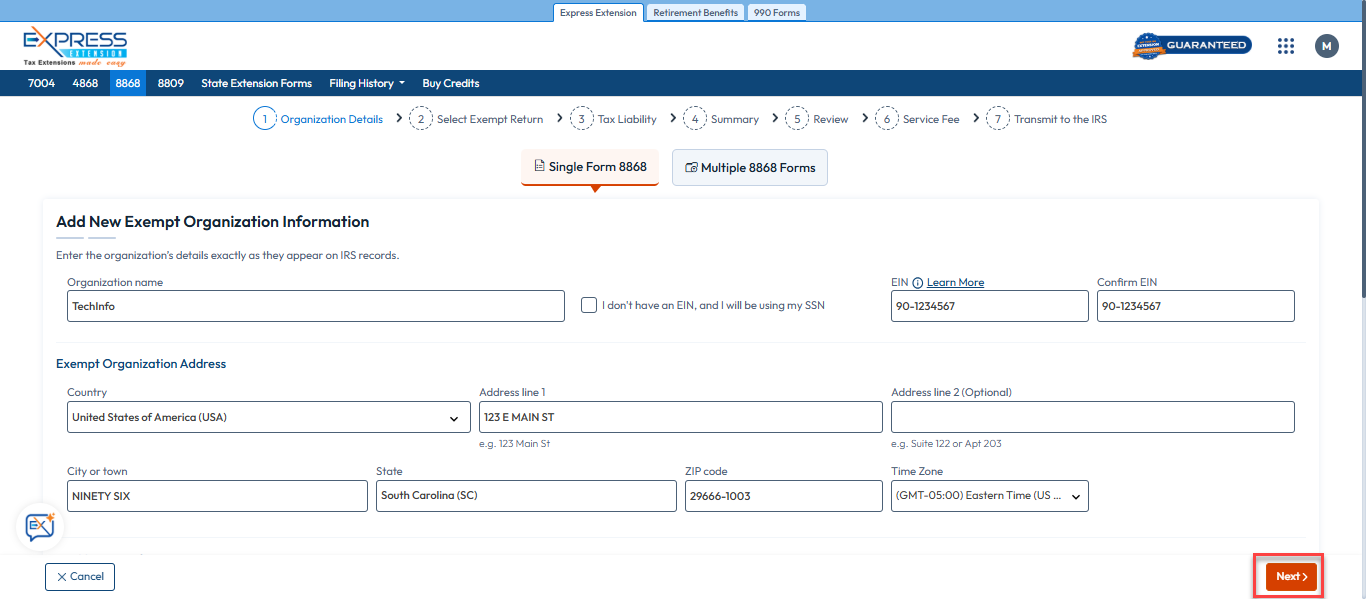

Step 4: Enter the information in the respective fields that match the IRS records. Verify all the required information is correct and click the 'Next' option.

Step 5: Select the form type that you want to file an extension from the dropdown menu.

On this page, you must fill out the required information regarding the tax year, the type of return you need to file, and the structure of your organization.

- Select the tax year: If your organization operates on a calendar year (January - December), select the 'Calendar Tax Year 2024'.

If it's operating on a different schedule, select 'Fiscal/Short Tax Year.' and mention the tax year starting date and ending date. Our system will calculate the due date and the extended due date based on your tax year. A short tax year only applies to businesses operating for less than 12 months.

- Details of an exempt organization return: Select the applicable boxes that describe your organization structure.

Once you've filled out the necessary information, verify it and click the 'Next' option.

Step 7: Enter the applicable tentative tax and payment details. If you owe any taxes to the IRS for the current tax year, enter the total tax amount, payments, and credits. You can choose the IRS payment method to complete the payment for your tax dues. To learn more about the IRS payment options, click here.

Note: Filing an extension ONLY extends the time to file your return; it does not extend the time to pay any taxes due. To avoid late payment penalties and interest, you must estimate the tax due and pay it when filing the extension.

Step 8: On the summary page, you can review the details you've entered and edit the information if needed. You can also download the draft extension form as a PDF. Once you verify the information, click the 'Continue' button for the audit check.

Step 9: All your in-progress returns are listed here. If you want to file them in bulk, select the returns appropriately and click ‘Continue to Audit.’

Step 10: Our system has audited your extension form based on the IRS business rules. If there are any errors, you can fix them and proceed to transmit.

Proceed to payment and transmit the form. After transmission, track the status of your return in the dashboard.

Need more help?

Get in touch with our dedicated support team Contact Us