My Business is recognized as an S-Corporation. Which form should I file to request an extension?

If your business is recognized as an S-Corporation, you can use the tax extension Form 7004 to request an extension of time to file the S-Corporation Tax Form 1120-S, U.S. Income Tax Return, with the IRS.

-

Form 7004 must be filed on or before the Form 1120-S deadline, which is the 15th day of the third month following the end of the business's tax year.

-

Upon filing Form 7004, you can get an automatic extension of up to 6 months.

Using ExpressExtension for Assistance

If you are unsure which business tax return to choose when filing an extension in ExpressExtension, you can take advantage of the inbuilt feature available in our application to help you select the right tax return based on your business entity type. Follow the steps below to minimize the chances of receiving a rejection from the IRS.

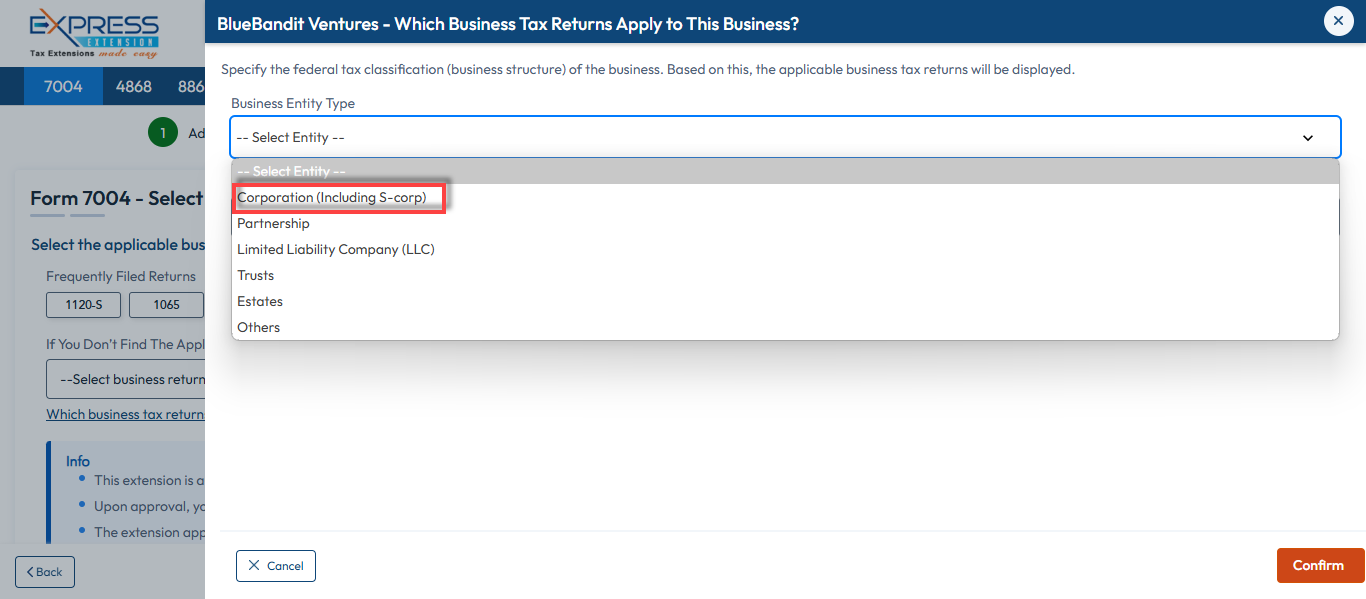

Step 1: Click the 'What business tax returns apply to this business?' link for assistance in choosing the correct tax return to file an extension.

Step 2: Select your business entity type as 'Corporation' from the drop-down list and select the appropriate business tax return you need to file an extension.

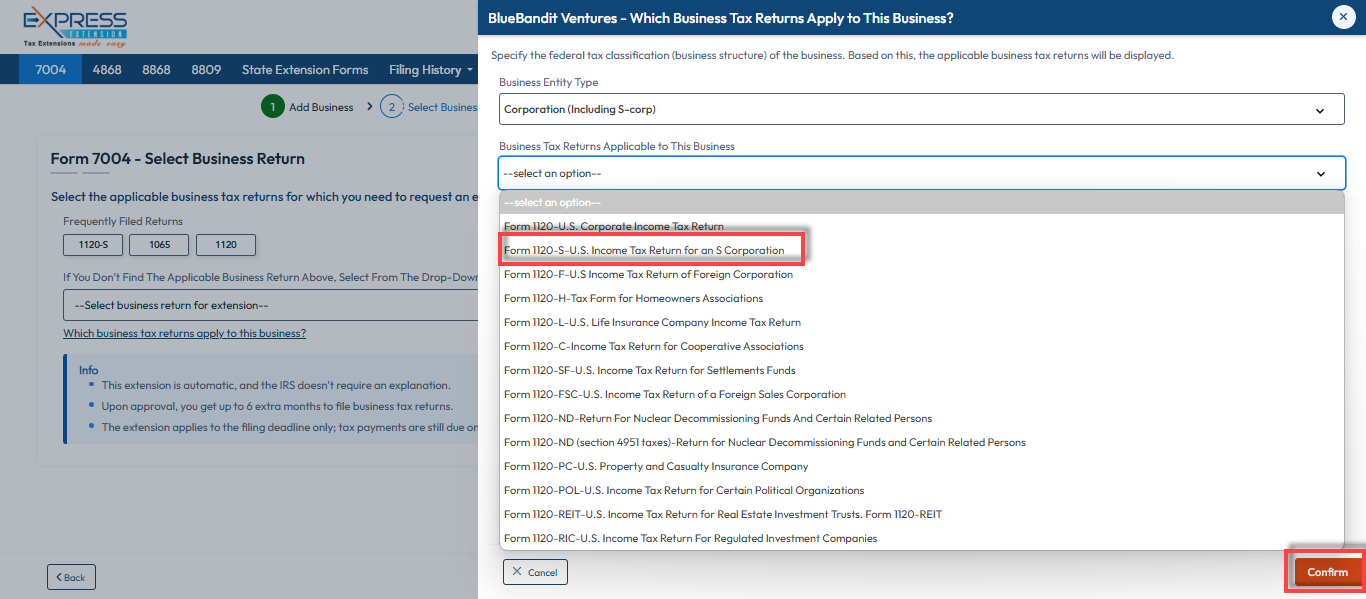

Step 3: Choose Form 1120-S - U.S. Income Tax Return for S-Corporation from the list and click Confirm to proceed with filing the extension for this business tax return.

Need more help?

Get in touch with our dedicated support team Contact Us